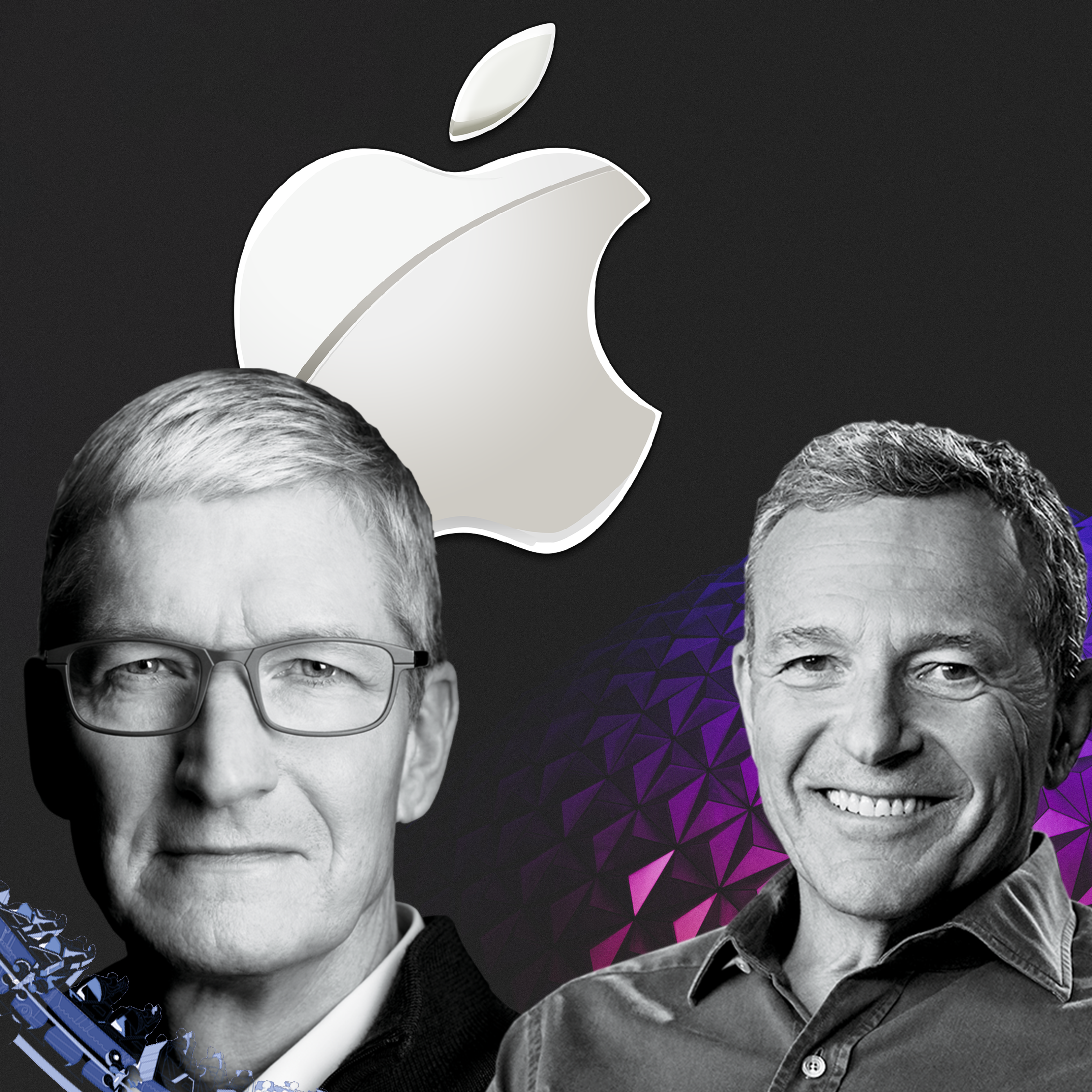

The entertainment world has been buzzing with intrigue over reports that Disney CEO Bob Iger may be prepping the company for a potential sale to tech juggernaut Apple. While any deal is still speculative at this stage, the implications of Apple acquiring the historic Disney brand are enormous to consider. In this article, we’ll analyze the rationale behind the sale, what assets Apple could acquire, and what this merger could mean for the future of both media giants.

Why Would Iger Look to Sell Disney?

First, let’s examine why Bob Iger may be open to relinquishing the iconic Disney empire. Iger previously stepped down as CEO in 2020 before returning to the helm two years later in 2022 after significant company turmoil.

Analysts suggest Iger was brought back primarily as a stabilizing force, to remedy missteps made under previous CEO Bob Chapek’s leadership. Chapek had invested heavily in building Disney+ and expanding Disney’s streaming content, whereas Iger seems intent on downsizing Disney’s media holdings during his second go-around.

After decades of expansion under Iger to acquire major brands like Pixar, Marvel, Lucasfilm, and 21st Century Fox, he now appears to be pulling back and divesting parts of the Disney media empire. With the film industry also potentially facing major headwinds from ongoing labor strikes, reduced moviegoing, and other economic forces, Iger may see wisdom in cashing out Disney assets sooner rather than later.

Selling off Disney while its brand value is still sky-high could give Apple access to creative franchises and intellectual properties it couldn’t build itself for any amount of money. For Iger, it could cement his legacy as the CEO who masterfully grew the Disney brand and set it up for continued success under new ownership. Both sides appear to recognize the unique potential gains from a merger at this moment in time.

What Assets Would Apple Be Buying?

If Apple acquires Disney, it would gain an unparalleled catalog of established entertainment properties. This includes powerhouse brands like:

Lucasfilm Ltd. (Star Wars franchise)

Marvel Studios (Marvel Cinematic Universe films)

Pixar Animation Studios (Toy Story, Finding Nemo, etc.)

Walt Disney Animation Studios (Frozen, Zootopia)

Disney Live Action Films (Pirates of the Caribbean, National Treasure)

Apple would also absorb Disney’s television holdings including popular networks like ABC, FX, Freeform, and of course, Disney Channel. ESPN would strengthen Apple’s limited live sports offerings. And Disney’s theme park business would become a lucrative new arm for Apple.

Disney+ itself could either be merged into Apple’s Apple TV+ streaming service or kept as a standalone brand. Disney also owns a controlling stake in the streaming technology company BAMTech, which could provide infrastructure Apple could utilize. And Disney’s pending acquisition of 20th Century Studios would hand some major film franchises to Apple, including Avatar and Planet of the Apes.

In one monumental acquisition, Apple would gain an absolute arsenal of creative firepower and globally revered entertainment properties spanning film, television, streaming, animation, live sports, and theme parks. The combined reach would be unmatched in the media universe.

Why the Deal Makes Sense for Apple

For Apple CEO Tim Cook, buying Disney would perfectly align with the company’s services-focused strategy for driving growth. After saturating the smartphone market, Apple is hungry for new subscription services to provide recurring revenue.

Apple TV+ has grown respectably but still lags far behind competitors like Netflix and Disney+ in subscribers. Buying Disney could instantly vault Apple TV+ into serious contention in the streaming wars. All of Disney’s beloved franchises and programming would give Apple TV+ immense influence as it continues taking on established players like Netflix and Amazon Prime Video.

Disney’s family-friendly catalogs are also a natural fit for Apple’s brand image. And as Apple continues to expand its live sports offerings, ESPN delivers broadcast rights deals for pro sports leagues that Apple still lacks. ESPN would also greatly strengthen Apple’s position in the sports betting market as more states legalize online wagering.

Owning Disney’s parks could be another lucrative play, given Apple’s expertise in managing brick-and-mortar retail experiences. Apple’s legendary design team could also have a field day reimagining how tech can enhance theme park attractions.

There are still major unknowns about Apple’s plans for augmented and virtual reality as well. Disney’s creative studios and IP could significantly bolster Apple’s upcoming efforts to deliver next-gen AR/VR entertainment experiences.

Overall, acquiring Disney would give Apple a preeminent position across the entire entertainment industry for years to come. The combined portfolio of brands and franchises would be the envy of Hollywood and Silicon Valley alike. For Apple, it could elevate their services business to an entirely new level.

What This Deal Would Mean for Entertainment

If this deal comes to fruition, it would undoubtedly signal a new era of entertainment industry consolidation. A Disney-Apple merged company would have unrivaled scale and access to resources across tech and content creation. With theatrical headwinds facing legacy studios, legacy tech companies are seeing a prime opportunity to become the new media titans.

Apple would have the incentive to invest heavily in maximizing exploitation of Disney properties across its various distribution channels including theaters, streaming, gaming, music, and live events. With Disney’s biggest franchises under its control, Apple could remake the entertainment landscape in its image.

At the same time, creatives may bristle under Apple exerting increased control over Disney’s storied film and animation studios. Apple would need to maintain enough autonomy so as not to stifle the “creative magic” that has become Disney’s calling card. Balancing these dynamics would be critical to preserving Disney’s cultural legacy under new ownership.

Regardless, an Apple-Disney combo would be poised to shape entertainment and pop culture for the digital age. It could propel Apple to the very pinnacle of media while amplifying Disney’s most iconic stories further than ever. If this deal develops past the rumor stage, it would unequivocally change the entertainment game for the foreseeable future.

The House of Mouse may soon have a high-tech owner. But Disney’s magical kingdom built by visionary founders like Walt Disney himself cannot be so easily replicated. For Apple, owning this one-of-a-kind entertainment icon could provide the creative rocket fuel to take its services business into the stratosphere. A Disney deal may be just what Apple needs to achieve complete entertainment domination.

+ There are no comments

Add yours